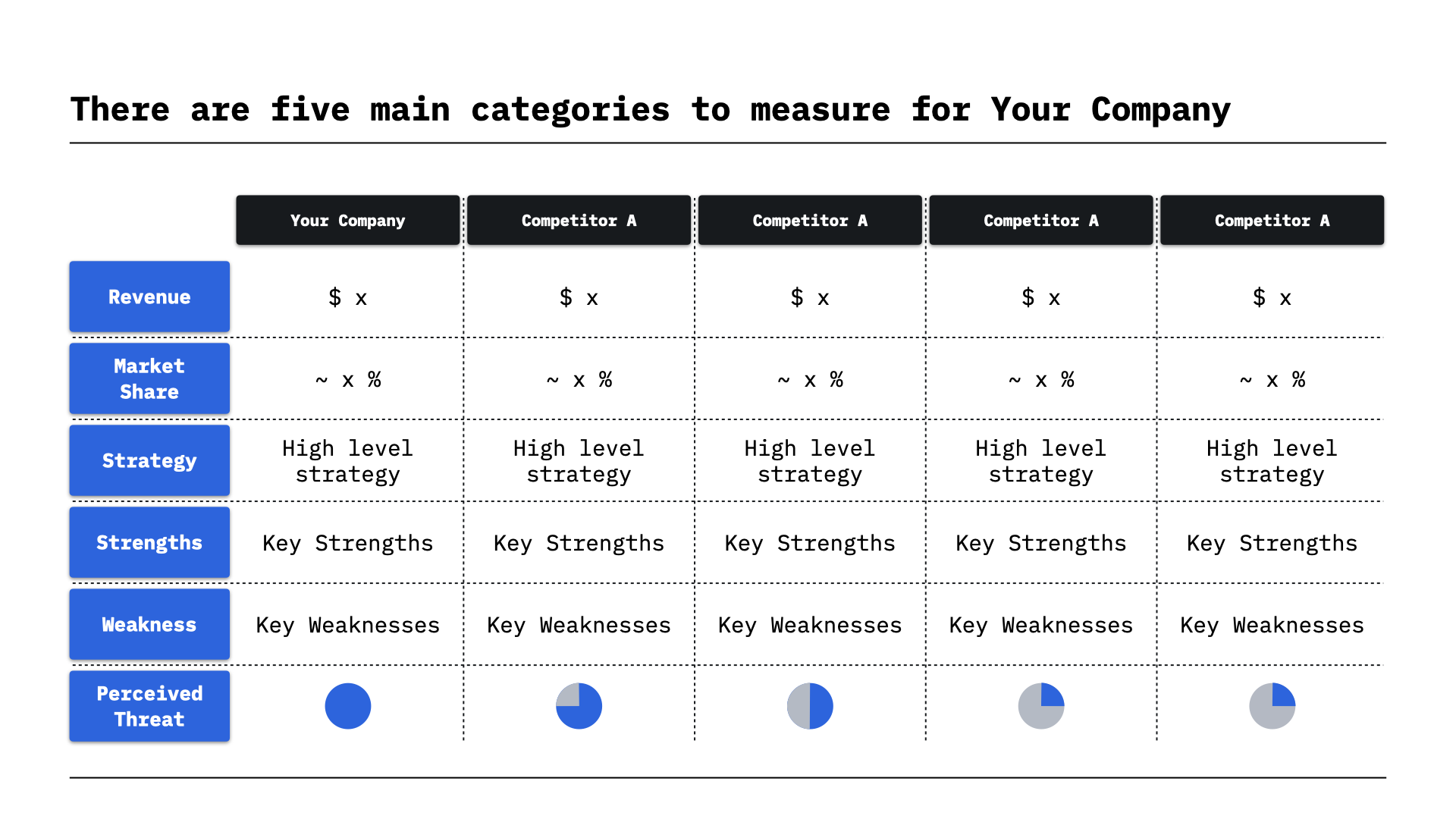

Optimization

5 Factors Every Business Owner Should be Using for Growth in Their Market.

Your business requires strategic decision-making based on solid data.

Understanding and tracking the right metrics is critical to ensure your business is on the path to growth and profitability.

By focusing on key performance indicators, you can gain the insights needed to make informed choices and maximize returns.

Here are five key metrics every REI business owner should use to drive success and ensure their business remains competitive and thriving:

1. REVENUE

Revenue is the total income generated from your properties, including rent, fees, and other income streams. It is the most fundamental measure of your business's financial performance. Revenue comes from different sources, such as tenant rent, parking fees, laundry services, and any other offerings you might have that contribute to overall income.

Why It Matters: Tracking revenue helps you understand your overall income flow, identify growth opportunities, and measure the effectiveness of your business strategies. Consistent and growing revenue is a key indicator of the health of your business. By monitoring revenue trends over time, you can quickly spot when income fluctuates and determine the underlying causes, allowing you to take corrective measures before issues escalate. Additionally, revenue insights can guide decisions on property improvements, marketing investments, and operational changes that boost your profitability.

2. MARKET SHARE

Market Share represents your portion of the total market compared to competitors. It indicates how well your properties perform relative to others in your area or sector. Market share can be calculated by analyzing the total number of units you manage or own, relative to the total units available in the market, or by comparing revenue to competitors.

Why It Matters: Understanding your market share helps you assess your competitive positioning and determine whether you need to adjust pricing, marketing, or other strategies to grow your presence. A larger market share often means your properties are more appealing to tenants, which can be a sign of competitive rent pricing, excellent property management, and a positive reputation in the community. By keeping an eye on market share, you can also identify market trends and shifts that might present growth opportunities, such as new target demographics or untapped areas with high rental demand.

3. STRATEGY

Strategy involves setting clear business objectives and mapping out the actions to achieve them. It includes defining your competitive advantage and making informed choices to navigate the market. A strong strategy encompasses not just financial goals but also growth plans, customer service approaches, and a clear vision of how technology and innovation can be leveraged to stay ahead.

Why It Matters: A well-defined strategy guides decision-making, aligns your efforts with your business goals, and helps you achieve sustainable growth. By having a strategic plan in place, you ensure that every action your team takes contributes to the long-term success of the business. Strategic planning helps you stay proactive instead of reactive, so you can foresee challenges and prepare for them in advance. This also means keeping a pulse on market conditions and adjusting your strategy to take advantage of emerging opportunities while mitigating risks. With a solid strategy, you create a cohesive vision that aligns your entire team, fostering collaboration and ensuring everyone is working towards the same objectives.

Identifying your strengths means recognizing what your business does exceptionally well, such as superior tenant relations, efficient property management, or attractive amenities. Strengths can also include unique selling propositions like having properties in prime locations, offering luxury amenities, or having a well-trained and experienced management team

Why It Matters: Knowing your strengths allows you to leverage them for maximum impact, differentiating your properties and delivering value that attracts and retains tenants. Highlighting your strengths in marketing materials can help you appeal to prospective tenants and set your properties apart from the competition. Strengths also help you build a strong brand reputation that leads to word-of-mouth referrals, reducing the need for costly advertising. Understanding what your business excels at helps you prioritize these elements in your operations and further develop them, giving you an edge in the marketplace.

Why It Matters: Addressing weaknesses proactively helps you mitigate risks, improve overall operations, and position your business for better growth opportunities. Being honest about your weaknesses allows you to create targeted action plans to strengthen those areas. For example, if tenant turnover is high, you might analyze your lease renewal processes, rental pricing, or tenant communication methods to identify what's causing tenants to leave. Proactively addressing weaknesses not only helps in avoiding negative financial impacts but also builds a better tenant experience, which directly influences occupancy rates and long-term success. Turning weaknesses into opportunities is key to maintaining growth and ensuring that your business remains resilient in changing market conditions.

How can I diversify my revenue sources to ensure stability?

What are the biggest contributors to revenue fluctuations?

Which areas of my property portfolio are generating the least revenue, and why?

How does my market share compare to local competitors?

What factors are most influencing my current market position?

Are there underserved segments of the market I can tap into?

What are the core objectives of my business strategy?

How can I make sure my team understands and aligns with the strategy?

Are there emerging trends that require a strategic pivot?

4. STRENGTHS

What are my top strengths in property management?

How can I leverage these strengths to attract more tenants/clients?

Are there ways to further develop my existing strengths?

5. WEAKNESS

Weaknesses are areas where your business needs improvement. Identifying these areas helps you develop targeted solutions to enhance efficiency, reduce costs, and improve tenant satisfaction. Weaknesses may include inefficient processes, lack of amenities compared to competitors, high turnover rates, or limited market presence.

What are my main weaknesses impacting business growth?

How can I develop practical solutions to address these weaknesses?

Are there underlying causes that need more attention?

Growth in real estate investment hinges on understanding and leveraging key metrics that provide insight into profitability, risk, and operational efficiency. By focusing on these five metrics—Revenue, Market Share, Strategy, Strengths, and Weakness—you can make more informed decisions that drive sustainable growth for your REI business. A proactive approach to measuring these factors helps you adapt to market changes, enhance tenant experiences, and continuously improve your operational effectiveness.

Ready to Accelerate Your Growth?

Take your real estate investments to the next level by leveraging a strategic approach that’s informed by the right metrics. Let’s dive deeper into these metrics and see how we can help you optimize your portfolio, improve efficiencies, and achieve sustained growth.